Chart

Download Report

Click here to download CFA’s The 2019 Secured Finance Market Sizing & Impact Study

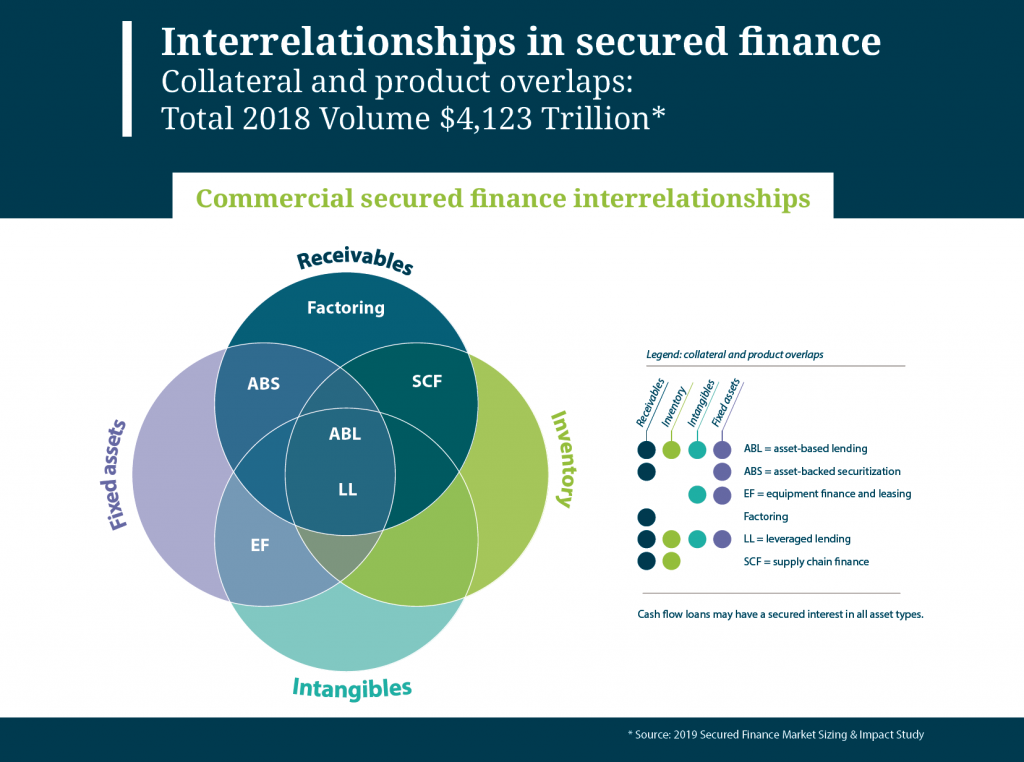

The 2019 Secured Finance Market Sizing & Impact Study demonstrates one overarching characteristic of secured financing activity is interrelatedness, with products and structures that may be complementary, interchangeable or transitional depending on borrower profile and stage of life cycle.

This is important because it underpins the options that are available to borrowers in choosing the most appropriate, or most cost-efficient, financing solution. It also provides the opportunities for lenders to grow and expand. For firms offering secured financings, understanding interrelationships can be critical to their marketing efforts and may translate to greater wallet share of the customer’s financing needs. As an example, a lender may bundle an equipment lease with an ABL facility where the ability to take cash dominion reduces the lender’s overall risk. Interrelationships occur between collateral forms, product types (see above chart) and contractual terms. Interrelationships also occur between financing and service providers, who can be the drivers behind a single borrower utilizing several financing forms and multiple lenders. Borrowers can grow into different or more advanced product types, or shrink and fall back on financing forms better suited for smaller or weaker borrowers. As discussed later, supply chain finance is probably the most illustrative of secured lending types involving complex interrelationships.

Contact: Aydan Savaser