Private Debt Intelligence – 5/25/2020

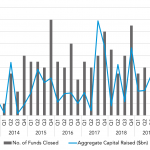

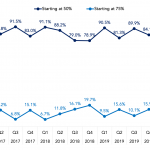

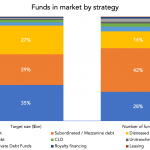

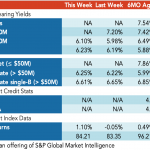

Has Asia-Focused Private Debt Been Impacted by COVID-19? The Asian private debt market is still relatively small, and expansion has been slower than in the more developed regions of Europe and North America. The region has yet to reach a ‘critical mass’, so activity remains cyclical. Has there been a significant change amid the pandemic…