High Yield Bonds and Private Credit (First of Two Parts)

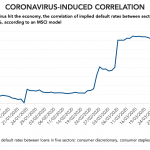

In our just-completed series on high-yield bonds [link], we conclude that issuer and investor activity has largely been driven by technical factors: near-zero interest rates, the Fed’s support of fallen angels, and skewed-to-worse ratings for leveraged loans. If this is the environment in the liquid market, how should investors be thinking of the illiquid market,…