Markit Recap – 2/15/2016

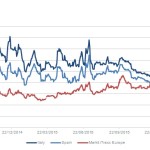

The shrinking of balance sheets has become a common theme in recent years, particularly in the financial sector. Investors are punishing banks that either unwilling or unable to implement a more conservative financial strategy. It is increasingly clear that the same phenomenon is now observed in the commodities sector. Mining firms need to scale back their…