TheLeadLeft

Chart of the Week – 7/7/2014

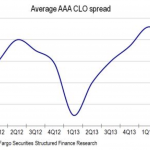

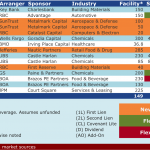

Treble Ahead New providers of triple-A CLO liabilities are expected to help tighten spreads to 135-140 bps by year-end. Beyond that, uncertainty on vehicle structures could reverse that trend…. Login to Read More...

Lead Left Interview – Scott Gluck

This week we speak with Scott Gluck, counsel at Venable LLP. Venable is a law firm with 600 attorneys in nine US offices. Scott assists private equity funds on a variety of corporate, legislative and regulatory matters. The Lead Left: Scott, tell us about your role at Venable. Scott Gluck: Thanks, Randy. My practice focuses on federal government…

The Pulse of Private Equity – 7/7/2014

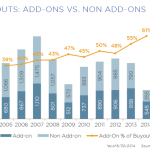

We have been pointing out the growing increase in Add-on activity for years, but it only continues to go up to new levels – so we will keep talking about it. In the first half of this year… Login to Read More...

Leveraged Loan Insight & Analysis – 7/07/2014

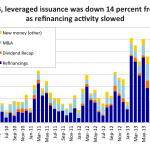

At $244 billion, 2Q14 leveraged loan issuance was down 14 percent from 1Q14 levels and a much higher 31 percent year-over-year. And for 1H14, leveraged lending of $527 billion… Login to Read More...

Leveraged Loan Insight & Analysis – 6/30/2014

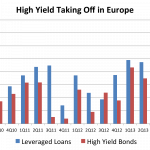

High-yield bond issuance in Europe has outpaced leveraged loan issuance so far in 2014, inverting a trend that has stood firm in Europe for decades. High-yield bond issuance in Europe has hit $131.8 billion… Login to Read More...

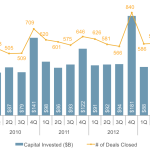

The Pulse of Private Equity – 6/30/2014

With a total of 483 U.S. deals being completed in the second quarter, private equity deal activity notched a decline of 35% from the first quarter. The decline in 2Q deal flow is likely the result of high purchase price multiples… Login to Read More...

Lead Left Interview – Robert Grunewald _ Part Two

This week we continue our conversation with Robert Grunewald, chief investment officer at BDCA Advisor, LLC. BDCA (Business Development Corporation of America) is a BDC focused on senior debt investments in middle market companies. Second of two parts – View part one TLL: Waive fees to preserve the dividend for investors? That is unusual. BG: With almost $2 billion…

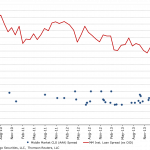

Chart of the Week – 6/30/2014

Arbitrage This While yields for middle market loans have generally contracted over the past four years, the cost of triple-A liabilities for middle market CLOs has been range-bound at L+175, about 25-50 bps higher than their BSL equivalents. MM Loans vs. MM CLO AAA Spreads… Login to Read More...