Debtwire Middle-Market – 9/18/2023

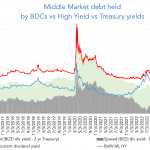

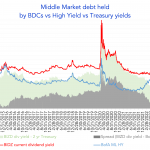

Source: VanEck BDC Income ETF, BofA Merrill Lynch US High Yield Effective Yield The red line in the chart is the current dividend yield of the *VanEck BDC Income ETF (currently at 10.5%) that tracks the overall performance of publicly traded business development companies (BDCs, lenders to privately held middle-market businesses that tend to be…