Debtwire Middle-Market – 11/14/2022

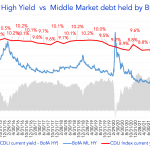

Leveraged borrowers jump at the opportunity to access debt capital amid market upturn Source: Debtwire Par, Markit Investors in the leveraged loan and high-yield bond markets rejoiced following a better-than-expected inflation reading last week that sent equity markets soaring. On Thursday (10 November) the US Bureau of Labor Statistics reported that core inflation slowed to…