DL Deals: News & Analysis – 9/14/2020

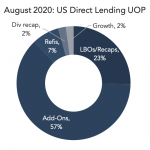

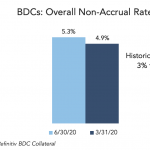

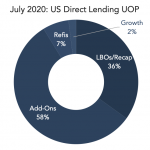

August amped up deal flow in lower middle market; Busy season ahead Lower middle market deal flow amped up in August, with volume exceeding July as lending found its footing amid calmer secondary prices and outflows. Quarter-to-date volume overtook 2Q weeks ago. Final numbers will be available in our upcoming Quarterly Report…. Login to Read