PDI Picks – 5/18/2020

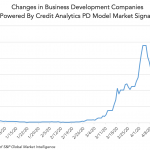

Will coronavirus prompt a new wave of distress? One of the long-term impacts of the global financial crisis was a sharp uptick in non-performing loans as lax underwriting standards prior to the crisis and the global recession that followed created a perfect storm where over-levered borrowers were unable to repay their debts…. Subscribe to Read