PDI Picks – 4/6/2020

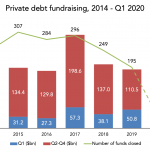

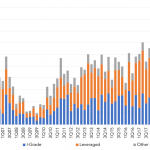

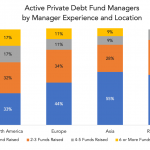

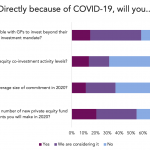

Fundraising in the time of coronavirus Private debt funds are finding it tough to raise capital, but this was true before the virus struck. In the face of the coronavirus pandemic and the enormous disruption it has produced in its wake, little surprise that private debt fundraising appears to be in decline…. Subscribe to Read