PDI Picks – 3/19/2018

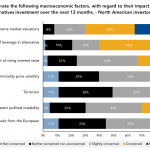

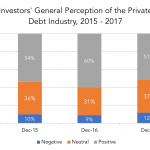

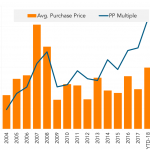

Thirst for yield overshadows other concerns Worries over market valuations are being suppressed by investors still keen to embrace the private credit and private equity markets. In our limited partner survey conducted recently, North American respondents told Private Debt Investor their biggest macroeconomic concern was “extreme market valuations”. On a scale of 1-5, investors registered…