Leveraged Loan Insight & Analysis – 5/6/2019

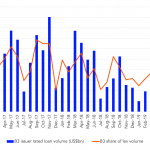

US leveraged loan volume seeing a higher share of B3 names While the US leveraged loan market is still challenged by lower supply, the share of B3 rated names by Moody’s has started increasing recently. In April, there was US$6.6bn of completed B3 issuer rated volume, the highest monthly total since October’s US$10.6bn…. Subscribe to