Private Debt Intelligence – 10/22/2018

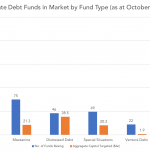

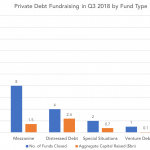

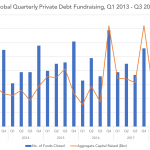

Looking at the Private Debt Funds in Market At the start of Q4 2018, there are 396 private debt funds in market seeking an aggregate $175bn in capital. This represents an increase of seven funds in market than at the start of Q3, but the funds currently in market are seeking $5.0bn less in aggregate…