Markit Recap – 10/1/2018

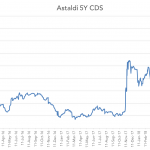

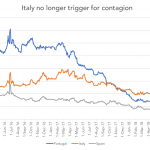

We noted last week that the markets may be guilty of complacency on Italy’s budget, and so it proved. As mooted in the initial spending plan, an increase in the budget deficit to 2.4% was proposed by the government, significantly higher than the 2% limit specified by the European Commission. This was tempered by the…