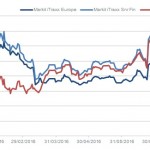

Markit Recap – 8/8/2016

Spanish engineering firms with exposure in Latin America may not be the most heavily traded segment of the credit markets, but they are certainly proving the most vulnerable. Isolux followed its counterpart Abengoa into default by announcing that it had won credit approval for a €2bn debt restructuring on July 28, and a bankruptcy credit…