The Pulse of Private Equity – 11/27/2017

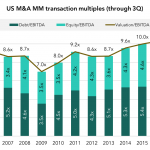

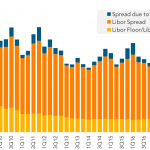

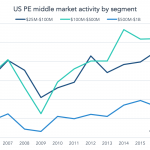

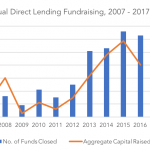

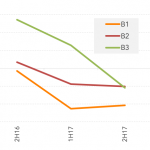

The middle market isn’t cheap Download PitchBook’s Report click here. Middle market activity has never been as strong as it is now. What used to be a space to find bargains has turned into just another frenzied market, one among many. The median valuation-to-EBITDA multiple for all middle-market M&A transactions is up yet again this…