Leveraged Loan Insight & Analysis – 5/30/2016

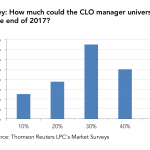

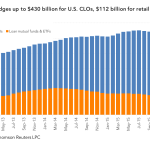

According to Thomson Reuters LPC’s year-end survey, the majority of buyside and sellside institutions surveyed estimated that roughly 40% of managers had a Risk Retention solution in place. Maybe not quite put the structure and funding in place but as we approach December 24th, managers have not just been evaluating the various solutions out there,…