Markit Recap – 6/6/2016

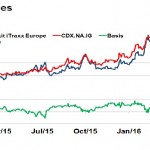

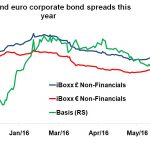

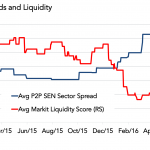

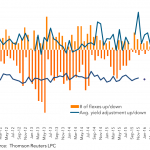

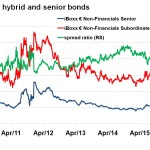

Tumbling volatility over the past months has seen US and European corporate credit risk converge, despite credit investors bracing themselves for diverging monetary policies. In a speech yesterday, Fed chair Janet Yellen remained positive about an interest rate hike in the coming months, while tomorrow marks the start of the ECB’s corporate bond buying programme….