Leveraged Loan Insight & Analysis – 10/16/2017

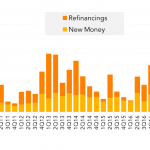

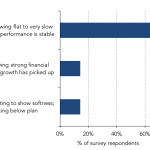

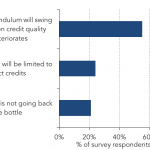

Strong investor appetite supports institutional issuance but tougher credits command better terms Despite robust market technicals including two weeks of retail fund inflows and a steady CLO pipeline, institutional lenders are reconciling strong demand for assets with discipline around credit quality. Roughly $34Bn of institutional loan volume has come to market early in 4Q17 and…