Leveraged Loan Insight & Analysis – 6/23/2014

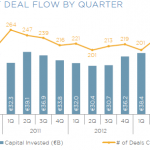

At nearly $240 billion, 1H14 sponsored loan volume to date is on a steady upward trajectory, with a 21percent increase over 2H13 issuance (although still shy of 1H13 totals of $335 billion) with almost two weeks left in the quarter. … Login to Read More...