The Pulse of Private Equity – 8/11/2025

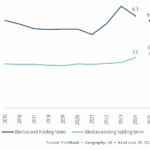

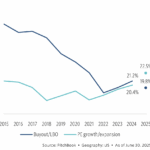

Median PE company holding times (years) Download PitchBook’s Report here. The data for median hold times for PE-backed companies in the US continues its downtrend, though it remains above historical norms…. Subscribe to Read MoreAlready a member? Log in here...