PDI Picks – 2/26/2024

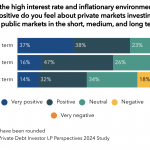

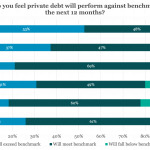

Private markets get the nod over the long term Investors are confident in the future of private markets, but fund managers have shown combining public and private market investment through flexible mandates can work well. Our recently published LP Perspectives 2024 study asked investors to compare prospects for public and private markets over the short,…