Fitch’s Privately Monitored Middle Market Portfolio Overview, 4Q23

In the charts above, Fitch presents aggregate data for MM companies, defined as in the area of $500 million of debt or $100 million of EBITDA or below, that it privately rates for asset managers.

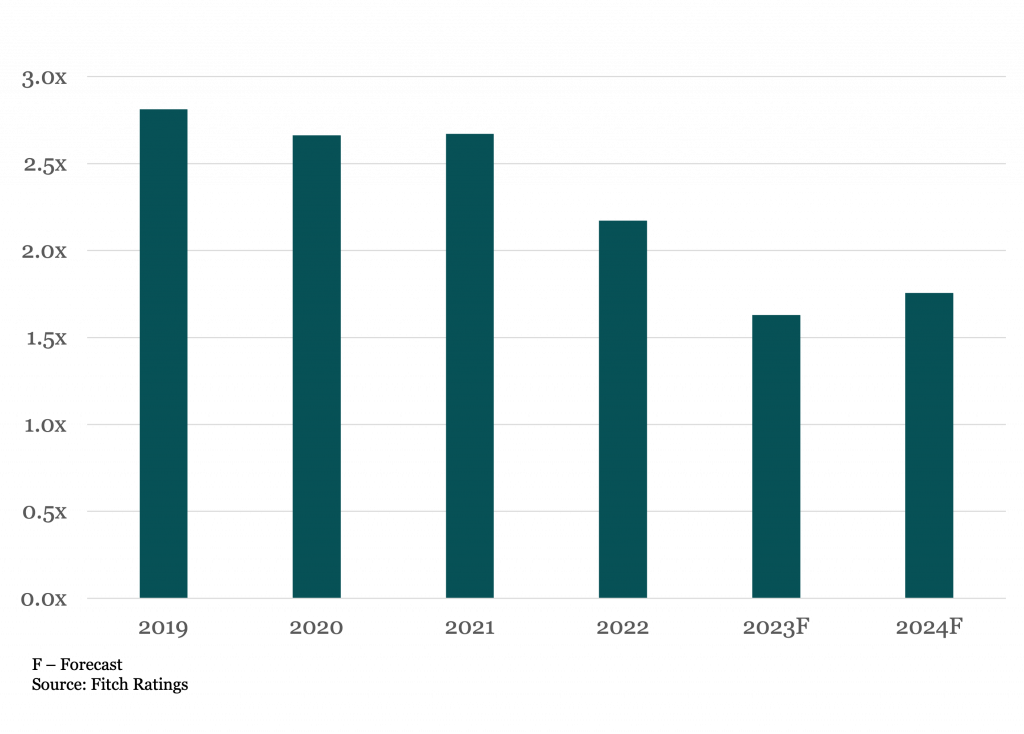

- Interest coverage (EBITDA/interest) is estimated to have declined to 1.6x in 2023 as a full year of increased rates and refinancings done at higher spreads fully flowed through income statements. In the high interest rate environment, interest coverage takes the spotlight as elevated interest payments can quickly exhaust liquidity for lower rated issuers. However, the utilization of PIK structures has become increasingly common within the private credit market, and has alleviated the cash interest burden for some issuers in Fitch’s portfolio. Historically, coverage had fluctuated in the 2.5x range before the current Fed’s tightening cycle, through which coverage peaked at around 2.7x in 2021 before declining to 2.2x in 2022 and further in 2023.