PDI Picks – 3/4/2024

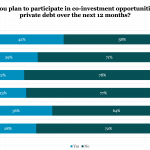

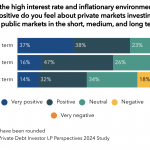

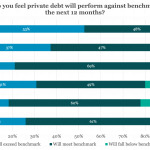

Co-investment comes to the fore More than 40 percent of investors are now looking at co-investments in private credit – representing a big increase in appetite. After many years of discussion, LPs are finally starting to benefit from co-investment opportunities in private credit. According to Private Debt Investor’s LP Perspectives 2024 study, more than four…