Leveraged Loan Insight & Analysis – 1/4/2021

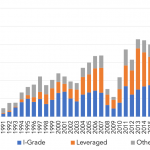

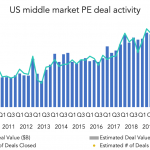

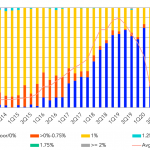

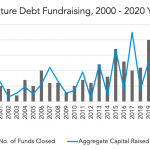

2020 US Syndicated loan volume at 10 year low amid pandemic In a year overshadowed by a global pandemic, social unrest and a prolonged US election cycle, lenders pushed over US$1.5trn of loan volume through the syndicated market, a 27% drop over the same time last year and a 10-year low. Although Covid-19 was the…