Leveraged Loan Insight & Analysis – 11/30/2020

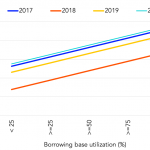

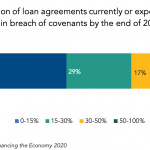

Pricing widens significantly for borrowing base E&P revolvers in 2020 Lending to the oil and gas upstream sector at US$17.3bn is down 78% so far this year from the total logged in 2019. With most of the lending to this sector coming from banks through reserve-based revolvers, many issuers have seen the availability tighten under…