PDI Picks – 11/9/2020

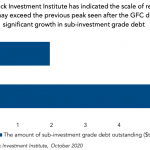

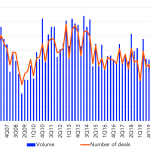

Are the clouds beginning to lift? The deal market is showing signs of picking up, as positive news on a covid-19 vaccine brings hope even to the worst-hit sectors. Speaking to sources in the private debt market has been a surprisingly uplifting experience recently. Following many predictions of doom and gloom in the spring of…