DL Deals: News & Analysis – 10/5/2020

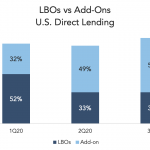

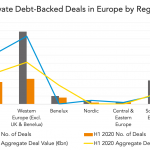

Third quarter finishes on high note; Lower middle market LBOs rally in Sept The second quarter’s heavy caution all but disappeared by last month in a swift reversal of deal flow. Uncertainty is onmnipresent, but investors have capital to deploy, financing has stabilized and after idling for six months, it’s risk on toward year end….