PDI Picks – 9/21/2020

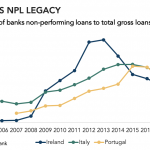

NPLs: Covid-19 creates new round of buying prospects The coronavirus crisis may not be as bountiful for Europe’s NPL investors as the GFC, but will offer select opportunities. Every crisis has its winners and losers and one asset class which came out on top after the global financial crisis in 2008 was European non-performing loans…