The Pulse of Private Equity – 10/12/2020

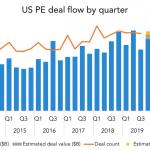

Carveouts – up but not booming Download PitchBook’s Report here. One of the earliest predictions back in March was that PE-led carveout activity would go up. PEGs had dry powder to spend and corporate sellers had liquidity concerns—they were also going to need to concentrate on their core businesses, so it made intuitive sense than ancillary…