Middle Market & Private Credit – 11/6/2023

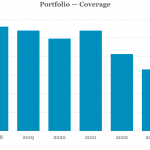

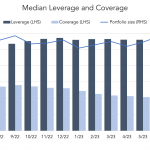

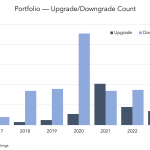

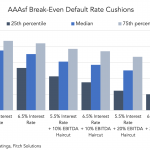

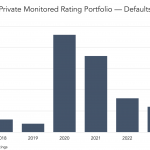

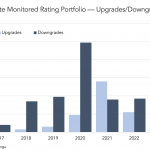

Fitch’s Privately Monitored Middle Market Portfolio Overview, 3Q23 Interest coverage (EBITDA/interest) within Fitch’s portfolio is expected to decline toward 1.7x in 2023 as a full year of increased rates and… Login to Read More...