The Pulse of Private Equity – 12/16/2019

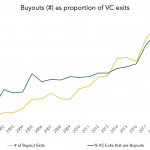

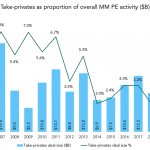

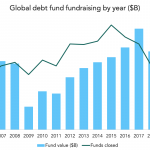

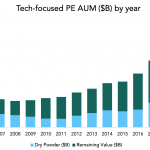

2020 prediction – more VC-to-PE buyouts Download PitchBook’s Report here. Our 2020 Private Equity Outlook went out last week, and we’ll delve into some of our predictions as we roll into the new year. One trend we expect to see more of is VC-to-PE buyouts. Though they’re often mentioned in the same sentence, venture capital and…