Private Debt Intelligence – 4/17/2017

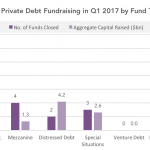

Private Debt Fundraising in Q1 2017 by Fund Type

The private debt industry recorded a strong start to 2017, as 21 vehicles reached a final close attracting $21bn in investor capital, despite marking a downturn from the record $50bn raised in Q4 2016. However not all strategies were able to capitalise on healthy investor appetite and attract high levels of commitments.

Direct lending funds in particular drove fundraising, securing their highest quarterly total of all time...