PDI Picks – 1/27/2020

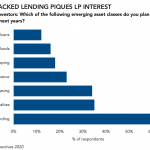

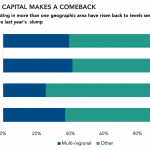

ABL draws significant LP interest Asset-backed lending is one of the credit strategies more investors are becoming attuned to. There could be another credit strategy set to pick up traction, according to PDI Perspectives 2020, our annual LP survey…. Subscribe to Read MoreAlready a member? Log in here...