Leveraged Loan Insight & Analysis – 6/22/2020

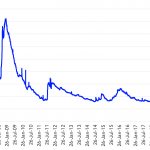

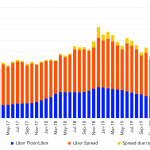

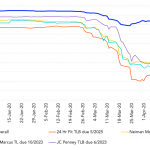

Bid/Ask spread finally narrows to 2 points but still historically high The average bid/ask spread in the overall US secondary market finally narrowed to 2.01 points yesterday after peaking at 3.52 points on March 27 and hovering above 2 points for 3 months. Previously, the bid/ask spread fell below 3-point mark on April 27 after hovering above 3 for a month and it’s been on a slow…