Leveraged Loan Insight & Analysis – 10/8/2018

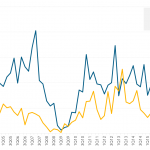

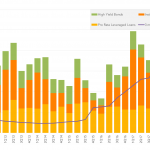

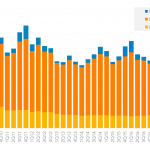

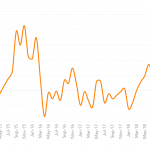

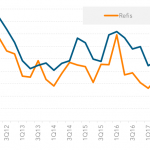

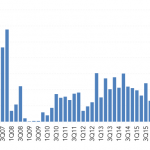

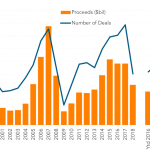

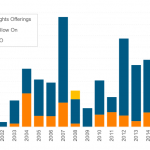

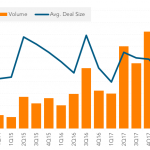

Syndicated middle market sponsored volume tanked in 3Q18 The summer of 2018 was not noteworthy for those middle market lenders that focus on sponsored deals. Syndicated issuance took a nose dive to just US$13.7bn in 3Q18, down 43% and 30% from 2Q18 and 3Q17 levels respectively. “We are only able to get crumbs in terms…