Leveraged Loan Insight & Analysis – 4/30/2018

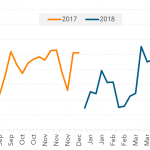

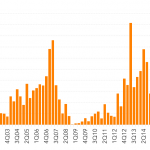

U.S. middle market loan pipeline reaches a new height The latest U.S. middle market pipeline figure hit US$6.1bn marking the highest level it has reached since Thomson Reuters LPC started tracking mid-market pipeline stats last year. Lenders in the middle market have said they have kept busy and the pipeline number backs this up. Helping…