Leveraged Loan Insight & Analysis – 11/27/2017

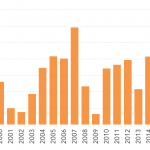

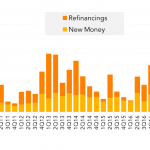

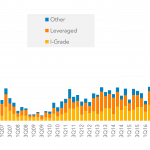

Middle Market LBO issuance hits post credit crisis high at $24B Despite lenders complaining of a supply demand imbalance for most of the year, middle market LBO issuance is actually quite robust in 2017. Year to date, syndicated middle market LBO loan issuance has already reached US$24.2B, the highest level tracked post credit crisis and…