Leveraged Loan Insight & Analysis – 10/21/2019

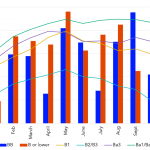

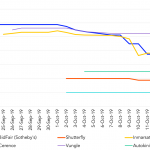

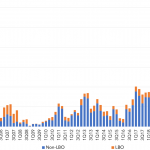

Flight to quality continues on in the US leveraged loan market Looking at year-to-date average secondary bids along with loan volume highlights the flight to quality seen in the US loan market over the past few months. Corporates with a rating of single-B or lower peaked in 2019 monthly volume with US$24bn back in May….