PDI Picks – 5/7/2018

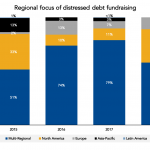

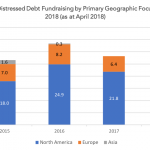

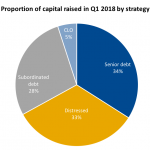

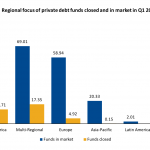

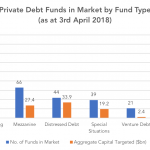

The decline of global distress? Investors are flocking to North America, particularly for distressed debt; the geography made up an outsized portion of the total capital raised for the strategy in the first quarter. The fundraising pendulum may be swinging back to North America, as we wrote several weeks ago, and that shift is particularly…