Private Debt Intelligence – 4/9/2018

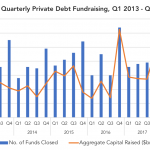

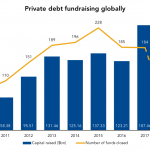

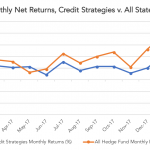

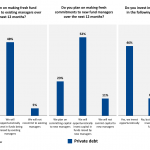

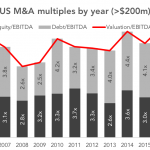

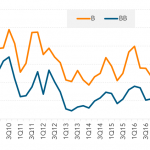

Private Debt: Slowdown in Q1 2018 The private debt industry had a banner year in 2017 in which 156 funds held a final close securing a record $115bn. This marked a significant increase from the previous record in 2015 when 178 funds raised a little over $100bn in capital. 2017 was also the only year…