Markit Recap – 11/12/2018

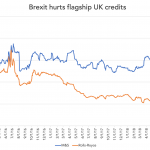

When market makers start sending runs based on nation states rather than sectors it may be a harbinger of fundamental change in how European credit is traded. That is precisely what we are seeing as the Brexit process descended into chaos. A number of UK cabinet members have resigned in protest at Theresa May’s draft…