KBRA Direct Lending Deals: News & Analysis – 9/8/2025

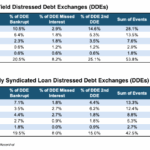

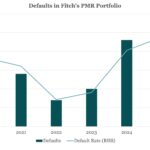

Defaults: Roughly 40% of restructured HY issuers were in trouble again within 24 months Click here to learn more. Distressed debt exchanges (DDEs), the alternative medicine to bankruptcy when it comes to treating problem credits, have long been criticized as temporary band-aids that lead to another restructuring or Chapter 11 anyway. Investors aren’t wrong…. Subscribe