Private Debt Intelligence – 6/12/2023

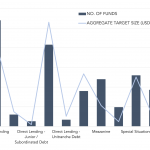

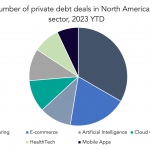

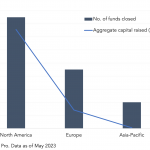

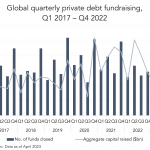

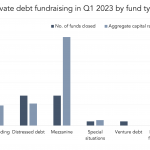

Direct lending dominates private debt funds in market Despite a tough financial environment, private debt continues to attract capital. This comes as no surprise given that over 80% of investors expect to commit more or the same amount of capital to private debt over the next 12 months, according to Preqin’s Investor Outlook Alternative Assets…