Private Debt Intelligence – 3/27/2023

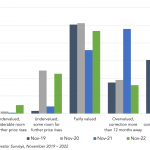

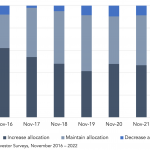

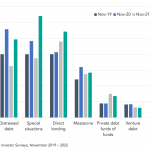

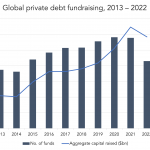

Private debt fairly valued according to investors Institutional investors believe private debt to be fairly valued, according to the latest survey for the Preqin Investor Outlook. In November 2022, 74% of respondents to the survey believed private debt was undervalued or fairly valued…. Login to Read More...