Leveraged Loan Insight & Analysis – 8/5/2019

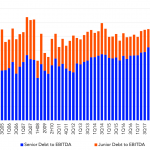

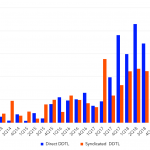

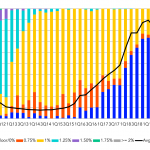

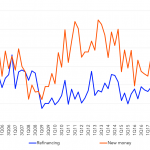

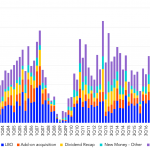

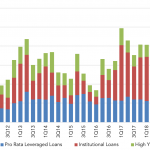

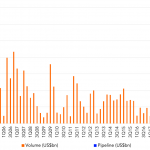

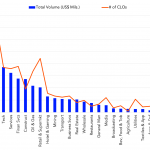

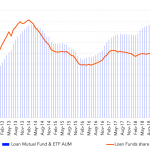

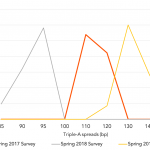

Aided by an increase in junior debt, total leverage on large corporate US LBO loans increases to 7x this quarter LBO activity in the US syndicated loan market remains robust this quarter. 3Q19 completed and in process LBO volume totals over US$23bn as new money deals continue to be a driver of leveraged lending. Meanwhile,…