Leveraged Loan Insight & Analysis – 5/27/2019

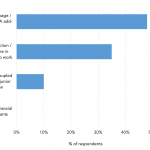

What characteristics of loans will cause the biggest problems in the future? When asked what characteristics of loans determine which middle market lenders will see the biggest problems in the future at LPC’s 7th Annual Middle Market Loans Conference, earlier this month, half of respondents chose weak documents, including aggressive EBITDA add-backs. Another 35% said…