Leveraged Loan Insight & Analysis – 11/9/2015

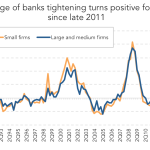

For the first time since late 2011, the net percentage of domestic banks reporting tightening terms over the past three months turned positive. Specifically, 8.8% of domestic banks reported tightening credit standards for approving applications for C&I loans or credit lines other than those used to finance mergers… Login to Read More...